What Does Hard Money Atlanta Do?

Wiki Article

What Does Hard Money Atlanta Mean?

Table of ContentsThe Hard Money Atlanta StatementsLittle Known Questions About Hard Money Atlanta.Hard Money Atlanta Can Be Fun For EveryoneThe Main Principles Of Hard Money Atlanta

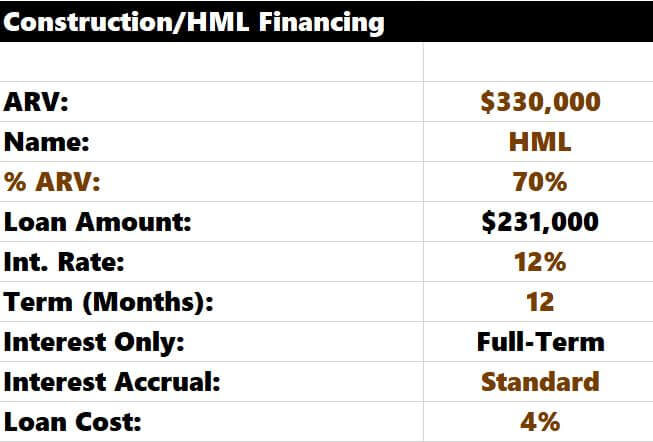

In a lot of locations, interest rates on hard money lendings run from 10% to 15%. Furthermore, a customer may need to pay 3 to 5 points, based upon the total financing quantity, plus any kind of applicable evaluation, evaluation, and also administrative charges. Numerous difficult money loan providers require interest-only repayments throughout the brief duration of the car loan.Difficult money lenders make their cash from the rate of interest, factors, as well as charges billed to the borrower. These lenders look to make a fast turn-around on their financial investment, therefore the greater rates of interest and also much shorter regards to difficult cash fundings. A tough money funding is a good concept if a borrower requires money promptly to invest in a building that can be rehabbed as well as flipped, or rehabbed, leased and also refinanced in a reasonably short time period.

They're also great for investors that do not have a great deal of collateral; the property itself ends up being the security for the finance. Hard money lendings, nevertheless, are not perfect for standard homeowners wanting to fund a building long-lasting. They are a beneficial tool in the financiers toolbelt when it pertains to leveraging cash to scale their business.

For private capitalists, the very best part of obtaining a tough cash car loan is that it is easier than obtaining a typical home loan from a financial institution. The authorization procedure is usually a lot less intense. Financial institutions can request for an almost unlimited collection of records and take numerous weeks to months to get a funding authorized.

Excitement About Hard Money Atlanta

The main purpose is to make certain the customer has an exit strategy and isn't in economic wreck. However many difficult money loan providers will certainly function with people who do not have terrific credit report, as this isn't their most significant problem. The most vital point hard money loan providers will certainly take a look at is the financial investment home itself.They will additionally review the consumer's scope of job as well as budget plan to ensure it's reasonable. Often, they will certainly stop the process because they either believe the property is too far gone or the rehab budget is impractical. They will certainly assess the BPO or evaluation and the sales and/or rental compensations to ensure they agree with the evaluation.

There is another benefit constructed right into this procedure: You obtain a second collection of eyes on your deal and also one that is materially spent in the job's outcome at that! If a bargain is poor, you can be relatively positive that a hard money lending institution won't touch it. Nevertheless, you need to never utilize that as wikipedia reference an excuse to abandon your very own due diligence.

The most effective area to seek difficult money lenders remains in the Larger, Pockets Tough Cash Lender Directory or your local Property Investors Association. Keep in mind, if they have actually done right by an additional financier, they are likely to do right by you.

What Does Hard Money Atlanta Mean?

Check out on as we go over tough money loans and also why they are such an eye-catching option for fix-and-flip genuine estate investors. One significant advantage of difficult cash for a fix-and-flip capitalist is leveraging a trusted lending institution's reliable capital as well as speed.You can take on tasks incrementally with these tactical car loans that enable you to rehab with just 10 - 30% down (relying on the loan provider). Difficult cash financings are usually short-term lendings utilized by real estate capitalists to money solution and also flip properties or other real estate financial investment deals. The residential or commercial property itself is utilized as security for the funding, and the high quality of the genuine estate deal is, therefore, a lot more crucial than the borrower's creditworthiness when certifying for the lending.

Nevertheless, this likewise indicates that the threat is higher on these finances, so the rate of interest are usually higher too. Deal with and also flip financiers choose hard cash due to the fact that the marketplace doesn't wait. When the chance emerges, and you prepare to obtain your index job into the rehab stage, a difficult money funding gets you the money straightaway, pending a fair evaluation of business bargain.

:max_bytes(150000):strip_icc()/GettyImages-1137516784-604537c07dad40eea021db81f5527ecf.jpg)

Some Known Details About Hard Money Atlanta

Intent and also residential or commercial property paperwork includes your in-depth extent of work (SOW) and insurance coverage. To examine the building, your lender will look at the value of similar residential or commercial properties in the area and their projections for growth. Following an estimate of the residential or commercial property's ARV, they will fund an agreed-upon percentage of that worth.

Report this wiki page